Once open enrollment ends (for this year it ends December 15th,) you will not be able to make changes to your plans for the upcoming year until next open enrollment UNLESS you qualify for a life event change such as a death or divorce that results in loss of coverage, marriage, or having a baby.

As you explore the options out there, we’ve outlined the major items and adjustments that have been updated for the upcoming year to help you make the most informed decision for you and your family.

When is open enrollment 2021?

For those who do not have insurance through a job like a small business, sole proprietor, or one-person show, open enrollment typically occurs towards the end of the year. For the upcoming 2021 year, open enrollment will go from November 1st, 2020- December 15, 2020. During this time, you can change the plan, enroll, or add people who may not have qualified to be added during the year because of a life changing event.

If you have health insurance as an employee through your job, you’ll likely receive information for open enrollment from your HR team or the person that handles your benefits. Because an employer can start a group health insurance plan at any time, their open enrollment can vary throughout the year.

What is a life changing event that will let me adjust my coverage mid-year?

There are four basic types of qualifying life events, and because they can happen any time during the year, they allow you to sign up for or change your health insurance coverage outside of the open enrollment period. They are…

- Loss of health coverage: The loss of a job or qualification for Medicare or Medicaid services, or aging out of your parents’ plan.

- Changes in household: A birth, adoption, death, marriage or divorce in the family.

- Changes in residence: Moving to a new region outside of your current insurer’s coverage.

- Other qualifying events: Becoming a U.S. citizen, leaving incarceration, joining or leaving the AmeriCorps.

Your health benefits might change

Under the Affordable Care Act, insurers in all states were required to meet 10 essential health benefits. In 2021, states can choose from 50 health benefits to provide more flexible plans. This means that you might have more options to choose from in 2021, but the coverage provided by each health insurance plan may vary, including the plan you chose last year. You need to carefully examine the types of coverage your family requires and choose accordingly.

Health Insurance is No Longer Required

Remember the days of the federal health insurance penalty? Me too! Those days are gone…for most of us. While Obamacare is not repealed, the penalty for not having health insurance is no longer in play beginning in 2018. If you reside in Massachusetts, New Jersey, Washington D.C, and most recently Vermont as of 2020. you are still subject to state mandates requiring you to have health insurance.

While it is no longer required for most states, it is still important to weigh the cost with the potential financial burden a health emergency could place on you, especially with COVID-19 epidemic going on. The bill for one trip to the emergency room can exceed an entire year’s worth of health insurance premiums.

Medicaid and Medicare open enrollment 2021

If you or a family member did not previously qualify for Medicare, Medicaid or the Children’s Health Insurance Program (CHIP) but you qualify now, you can apply at any time. Here’s how to figure out if you qualify for these federally funded health insurance program:

Medicaid & CHIP coverage

The Medicaid and CHIP programs were put in place to help low-income individuals, families with children, pregnant women, the elderly and people with disabilities. Even if you don’t think you’ll qualify for Medicaid based on your income, it’s still worth applying. Each state offers different state-level programs, and you could qualify for aid there. Visit HealthCare.gov to apply.

What is Medicare coverage

Medicare is the national health program for individuals who are 65 or older. Those with disabilities have the potential to possibly qualify at a younger age. You can check the list of plans here or at medicare.gov.

When is Medicare open enrollment?

Medicare, unlike Medicaid, has an open enrollment period in which those eligible for parts A and B can change plans, drug card, and Medicare supplement. The Medicare open enrollment period began on Oct. 15, 2020 and ended on Dec. 7, 2020. Coverage kicks in on Jan. 1, 2021.

Be careful though. Unlike most health insurance plans, with Medicare you must go through underwriting with your health. If you’ve had a major health issue in the past year, it may not be worth taking the risk of switching plans.

What insurance benefits should I review this year?

With health care costs increasing, it’s not uncommon for companies to change insurance plans or providers from one year to the next. This makes it even more important for you to pay attention when you’re looking at your benefits. Not only could the cost and coverage change, but your out of pocket could potentially rise if you are planning on a health event in the upcoming year.

Find the right health insurance plan

Each person is different when it comes to your health needs. Do you have a condition the requires you to visit the Dr. frequently and use a lot of prescriptions? A low deductible with a reasonable max out of pocket may be a good fit for you. Are you fortunate enough to only visit the Dr. on the rare occasion? A higher max out of pocket may be a good fit with the benefit of some cost savings for your wallet. These considerations will help you consider what is the best fit for your Oklahoma health insurance.

If you anticipate no major or recurring medical expenses in 2021, you should consider choosing a high-deductible plan and pairing it with a Health Savings Account (HSA), if your company offers this. Sure, with a high-deductible plan you pay more out-of-pocket for each doctor’s visit before your insurance kicks in, but you may not actually need to see doctors all that often outside of your annual checkups and preventive visits. Meanwhile, your monthly premiums will be lower than they would with a low-deductible plan.

But if you expect to spend more on medical care on a regular basis, you might want to choose a low-deductible plan. A low-deductible plan comes with higher monthly premiums taken out of each paycheck, but your coverage kicks in sooner, costing families with high medical expenses less in the long run.

Is a HSA (Health Savings Account) right for me?

An HSA or Health Savings account will only be available to those that qualify for a HSA high deductible plan. If you do qualify, it’s worth taking advantage of. Health Savings Accounts allow you to sock away money pre-tax for medical needs. This can health lower your tax bill at the end of year. There’s also a benefit that if you don’t need to use the savings, they are treated much like a traditional IRA. Win Win!

HSA contribution limits for 2021

- Individual: Contribution limit: $3,600, Age 55+: $4,600

- Family: Contribution limit: $7,200, Age 55+: $8,200

There’s even benefits if you’re over the age of 55. Those that are 55 and over can contribute an additional $1,000 to their HSA. If you have a partner also over the age of 55, both of you can add the additional $1,000. HSAs are filed under one person’s name. If you wish to be eligible for the extra $1,000, you and your partner must each open up their own individual HSAs and contribute the maximum of $9,200.

What about a Flexible Spending Account?

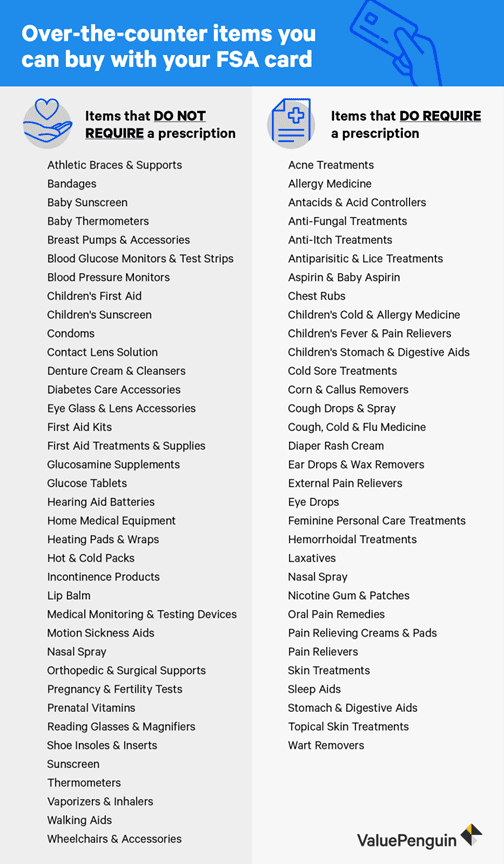

Flexible Spending Accounts (FSAs) are similar to HSAs, but with one key difference: FSAs follow a “use it or lose it” annual policy. In this way, FSAs aren’t as attractive as HSAs, but they still let you save money on taxes, medical expenses and prescriptions. Just remember: You’ll lose any amount you don’t spend by the end of the following year.

That said, the list of qualifying expense is surprisingly broad and includes items such as glasses, contacts and even sunscreen. This means that spending shouldn’t be too hard.

Some companies even take it a step further and will offer an FSA for your dependents. If you have children under the age of 13, you can contribute up to $5,000 to these FSAs. This can help with expenses like day care, after school programs, and nanny expenses. Dependent Care FSAs can also cover the cost for a relative or spouse in your household who is physically or mentally unable to care for themselves. Since these costs are necessity for many families, a fully funded dependent care FSA is a great tool.

Do you need dental and vision insurance?

Many benefits packages include dental and vision as part of the deal. If that’s the case, think through whether your family need these two coverages. If for example, you or your spouse wear contacts or need glasses, vision will be important.

It’s important to note that children under the age of 18 are required to have dental coverage. If you do not purchase a separate dental plan, pediatric dental is often automatically included in your health plan with many health insurances companies.

Should you get life insurance coverage?

Some but not all employers will offer a limited life insurance policy for often free of charge or a very low cost. If it’s free or only a few dollars a month, why not take it? While the amount covered is typically not a large sum of money, if will still help if something happens to you.

Generally, it’s suggested you should carry five to 10 times your annual salary in term life insurance. Since that’s the case, some employer life insurance plans have options to upgrade. Make sure to compare this cost with your own private life insurance. If you are relatively health with no major health issues in the past, this could be an affordable route. If you have major health conditions recently like a heart attack, stroke, or other items, it may be hard to get life insurance companies to insure you.

How Do I Get a Group or Individual Health Quote?

Getting a quote is easy, Just visit our website at www.eciagency.com and you can text or use the chat box to send the information needed. If you’re looking for a group quote for your business, this is going to include a list of your employee names, dependent names if they are applying for coverage, sex of all those listed, and birthdates of all the individuals. If you are looking for a quote for just you and your family the information needed will be your names, sex and birthdates.

Written by: Avery Moore